Purchasing liability insurance may not be the most exciting part of owning a business, but it is one of the most important. Regardless of your business’s size, if you don’t have the right insurance coverage, you could end up with a huge bill for any damages where your business is considered liable.

(info-graphic below article)

Protecting Your Employees

You are responsible for your employees when they are on the clock, and even if you have the safest workplace on the planet, accidents can still happen. All it takes is one slip on a hardwood floor and you could end up paying replacement wages for as long as the injured employee is out of action, along with any medical bills they incur (and as you probably know, medical bills aren’t cheap).

When you have liability insurance, it helps cover any bills you have in the event of an employee becoming ill or injuring themselves, including medical expenses, replacement wages, and disability/death benefits. Without insurance, you’re on the hook for those costs, which could be tens of thousands of dollars or more. Liability insurance covers costs even if your employee injured themselves from following your instructions.

How important is it that you have insurance for accidents or illnesses involving your employees? In the last 20 years, the number of employee lawsuits has increased by 400 percent, and 41.5 percent of those lawsuits are brought against private companies with under 100 employees. You don’t want your business to get taken down by one employee lawsuit because you didn’t have the right insurance.

Protecting Your Customers

Imagine that you’re considering partnering with a small business. You meet with the business’s owner and discuss the terms of the arrangement. Everything is going well, and you’re able to set up a deal that’s beneficial for both parties. Then, you find out that the business doesn’t have any liability insurance, and you realize that one accident could cripple the business and ruin your deal.

Big clients understand risk very well, as it’s part of how they became successful. A lack of liability insurance is an unnecessary risk that many potential business partners will be unwilling to take. If you don’t obtain liability insurance, you may end up missing out on profitable business deals.

Protecting Your Business

There’s no shortage of frivolous lawsuits, and unfortunately, small businesses are a often the targets. People know that the largest corporations have high-powered legal teams and are better able to handle lawsuits, whereas small businesses are usually more vulnerable.

When you’re stuck in a lawsuit, it’s going to cost you money whether you win or lose. Small businesses spend over $100 billion on legal issues every year and pay out $35.6 billion in settlement claims. On average, you’re looking at costs of $54,000 for a premises liability lawsuit, $91,000 for a contract dispute, and $122,000 for a malpractice lawsuit. Without liability insurance, one lawsuit can take you from a profitable year to the verge of bankruptcy.

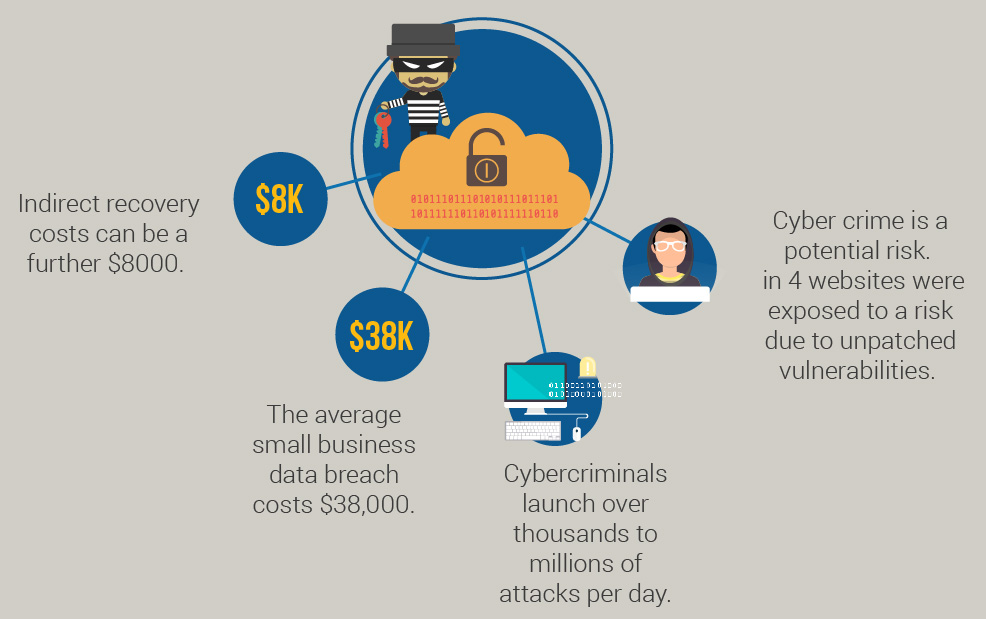

Planning to take your business online? In this day and age, it’s almost a necessity, but it also opens you up to all kind of threats. Every day, cybercriminals launch thousands and sometimes even millions of attacks, and they can hit you from all angles. Maybe one of your employees clicks on a phishing link from a work email account and enters confidential information, or maybe your company’s website is among the one in four that has an unpatched vulnerability.

One of the most dangerous aspects of cybercrime is that it can take days or weeks before you even realize that your data has been breached. On average, small business data breaches cost $38,000. You could also be looking at another $8,000 for indirect recovery.

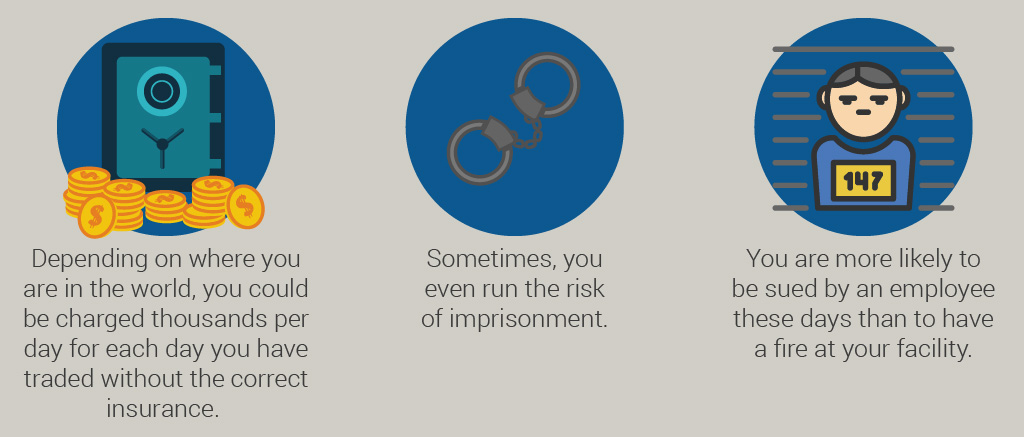

Liability insurance isn’t just smart, in many areas, it’s required by law. If you operate your business without the correct liability insurance, the government could fine you thousands of dollars for each day of operation. In some cases, you’re risking imprisonment by not having insurance.

It’s an old adage, but it still rings true to this day – prepare for the worst, expect the best. In this case, the worst is that your business ends up liable for costly damages. Don’t make the mistake of assuming that your business is safe. There are better odds of an employee suing your business than of a fire occurring at your facility. Make sure your business is ready for anything by obtaining enough public liability insurance to cover you in case of any incidents.

(click to enlarge)

Embed This Infographic

Copy and paste the code below to get this infographic onto your website or blog.