The workplace of today is just as likely to be headquartered in your home as it is in a traditional office setting. If you are the owner of your business and you run it from your residence, there are additional factors that you need to consider. Understanding the type and extent of the insurance you require should be one of your first priorities.

(infographic below article)

Covered By Homeowners Insurance

Long before people were running companies out of their homes to the degree that they are now, they were purchasing insurance policies that covered their residence against damage from any number of events. Whether it was fire, a lightning strike or the ravages of a severe storm, homeowners coverage helps people to rebuild and recover from any number of calamities. The policies also addresses financial losses that resulted from injuries caused by these unforeseen catastrophes. In addition, traditional homeowners coverage protects the policy holder if personal property is lost, stolen or vandalized.

Finally, standard coverage provides a financial safety net for the owner if that person or his or her pets injures a third party whileon the property. Such situations, when not covered by insurance, can lead to expensive and protracted lawsuits. This underscores the importance of obtaining an excellent, comprehensive homeowners policy for all residences.

Homeowners Insurance Covers Your Home And Personal Property But What If

While the importance of this type of policy cannot be overstated, it is also crucial to understand that it is limited. If you begin to use your residential property as the headquarters for your business, you cannot assume that your standard homeowners insurance will be adequate. It may not cover you against the loss of intellectual property that would occur if your business computer was stolen or vandalized. Nor can you count on it protecting you if someone is injured while making a business-related delivery on the property. Finally, you cannot simply assume that it would compensate you for the loss of inventory damaged by fire or flood. At the very least, it is vital that you consult with the agent who sold you your homeowners policy to learn exactly what it does and does not cover.

Other Risks That Aren’t Covered By Homeowners Insurance

While many of the situations cited above lie in a gray area that may or may not be addressed by your homeowners policy, there are some scenarios that never are. Let’s say, for instance, that your company’s computer systems were hacked or you were the victim of a virus that caused you to close your doors until the problem could be solved. By the same token, imagine that equipment vital to your line of work failed, requiring that parts be ordered and interrupting the normal flow of your commerce. Neither of these business interruption situations is ever covered by a standard residential policy. Nor would you be protected if you or one of your staff members gave poor advice or manufactured a product that caused injury to a customer.

Why A Home-Based Insurance Policy Is So Important

Fortunately, home-based business insurance comes in to fill this huge gap. Where homeowners coverage falls short or is nonexistent, this insurance protects you. What’s more, it goes beyond what you could obtain if you simply purchased additional riders or endorsements that could be added to your homeowners policy.

What does home-based business insurance cover above and beyond your existing residential policy? For starters, you can protect yourself against the cost you would incur if your data were lost due to virus, damage or hacking. You can also be safeguarded against the consequences of errors or omissions that you or one of your staff may inadvertently make. In addition, this type of coverage acts as a buffer between your business and personal assets, markedly reducing the chances that you could lose your home or your savings in the event of a business-related lawsuit. Finally, this type of coverage is less expensive than a full business owners policy, yet it helps to keep your residential and company coverage separate. Thanks to this distinction, it is unlikely that your homeowners policy will be canceled.

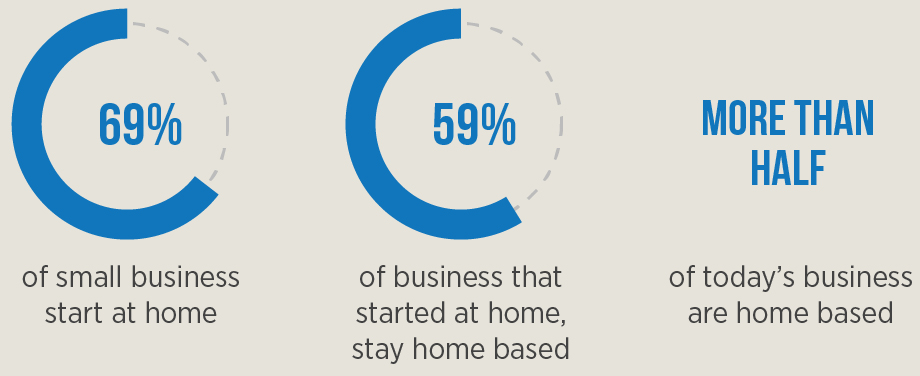

Facts About Home Business

Just a few brief statistics will help you to see how the commercial world is changing. A full 69 percent of all businesses begin at home. Out of that number, 59 percent, more than half of today’s enterprises, remain home-based. Because this trend seems to be on the upswing, it is more important than ever for entrepreneurs to obtain both homeowners and home-based business coverage that will protect them against the many unforeseen events that can bring companies to their knees if they are not properly protected.

(click to enlarge)

Embed This Infographic

Copy and paste the code below to get this infographic onto your website or blog.