Owning a business carries with it numerous risks. In order to minimize them as much as possible, it is essential that you purchase insurance. Learning about your various options can help you to decide exactly what coverage is best for your valuable enterprise.

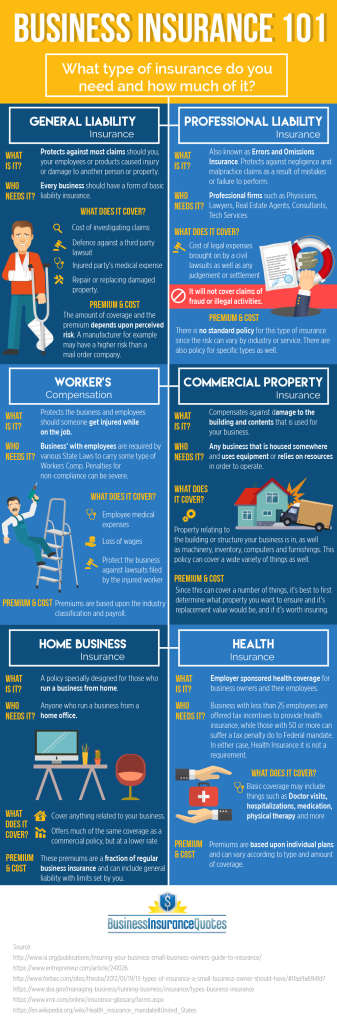

(info-graphic below article)

GENERAL LIABILITY INSURANCE

GENERAL LIABILITY INSURANCE

This is the foundation of all coverages for your business, protecting you against claims of bodily and personal injury and property damage as well as others that come about due to the operations of your company. Although it is frequently combined with property coverage in a Business Owners Policy (BOP), it also can be purchased in stand-alone form. Because this type of insurance helps to pay for the cost of investigating a claim against you, defending you in the event of a lawsuit, paying the medical expenses of the injured party and any damage to your property, this insurance can be worth its weight in gold should the worst happen. What you will pay for general liability coverage will depend to a great extent on how risky your business activities are perceived to be by the insurer. For instance, a construction contractor’s premiums would be much higher than those of a tax preparer because of the greater chance of accidents and injuries on the job.

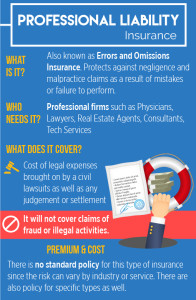

PROFESSIONAL LIABILITY INSURANCE

Everyone has heard of the malpractice insurance that physicians are required to purchase, but it is only one of several types of professional liability insurance, commonly known as errors and omissions coverage. In fact, anyone in the business of providing advice, technical assistance, counsel or real estate services should have strong coverage in this area. That’s because it protects you in case you or one of your employees unintentionally gives bad advice or otherwise makes a mistake or manufactures a product that causes injury to a third party. Once you are protected by this coverage, it will pay the costs involved if you are sued in civil court as well as any judgment against you. The premiums you will pay are dependent on the industry in which you work.

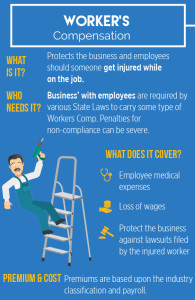

WORKER’S COMPENSATION INSURANCE

WORKER’S COMPENSATION INSURANCE

Your employees are one of your most valuable assets. Should one of them become injured on the job, there can be adverse consequences for everyone involved. While the worker must grapple with physical pain, medical treatments and expenses as well as lost wages, you must find ways to carry on in spite of the person’s absence. Worker’s compensation coverage can protect you and your employees against the negative effects of on-the-job injuries. It covers the cost of employee medical expenses and lost wages while simultaneously protecting you against being sued by the worker. Check with your state to learn about the exact coverage you are required to obtain. Failing to do so could result in some very stiff penalties.

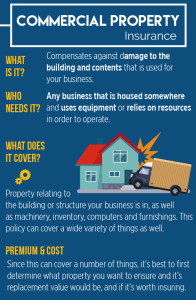

COMMERCIAL PROPERTY INSURANCE

Whether your company only has a few employees and resides in one cozy room or is big and occupies an entire large building, you need commercial business coverage to protect your property, equipment and other assets. In order to ascertain the extent of the coverage you need, it is necessary that you accurately itemize the costs of all the buildings, inventory, furniture and equipment you wish to protect. Commercial coverage can be very flexible, so be sure to speak with your agent about your specific needs to guarantee that all of your concerns are addressed before you sign on the dotted line.

HOME BUSINESS INSURANCE

HOME BUSINESS INSURANCE

If you run your business from your home, this type of coverage might be exactly what you need. Note that you won’t need it if you simply work out of your home office remotely for a company you do not own. Also, don’t fall into the trap of believing that your home-based business will automatically be protected under your homeowner’s policy. In fact, you will probably need to have additional riders placed on your policy if you want to go this route. Be sure to be totally honest with your agent about the nature of the work you do, including how many employees are on your payroll and if customers regularly visit you at your home workplace. Once you get the coverage you need, you may well find that the premiums for this type of coverage are substantially lower than commercial coverage would be while still giving you the protection you need.

HEALTH INSURANCE

One of the best ways to keep your valued employees for longer is to offer them health insurance. Most small companies buy into a group plan, with the workers contributing a certain amount to supplement the cost of their coverage. If you have fewer than 25 employees, you may be eligible for a tax break if you provide these benefits to your workers. Even if you are not eligible, you will still reap the rewards that come from having happy workers who remain loyal to your company in part because of the health benefits they receive. These can include help with the cost of getting checkups, receiving physical therapy, chiropractic care, medications, emergency room visits and hospitalizations.

(click to Enlarge)

Embed This Infographic

Copy and paste the code below to get this infographic onto your website or blog.