Embed This Infographic

Copy and paste the code bellow to get this infographic onto your website or blog.

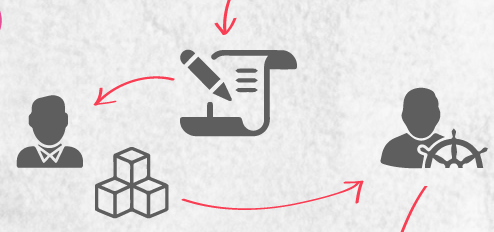

History of Insurance

Think for a moment about how a fire starts. It only takes one burning ember and a flammable substance. If the two touch, a conflagration can be created virtually instantaneously. This scenario perfectly illustrates the concept of insurance. That glowing ember is risk; it has the potential to cause destruction under the right circumstances. Insurance is the bucket of water that stands at the ready in case a spark flies. Although it might sometimes seem easier not to go through the effort to keep that bucket filled, the results of not doing so can be disastrous. This idea of insurance is not a new concept. In fact, it has been around since the most ancient of times.

3000 B.C. CHINA

Pioneers in any number of areas such as inventing both gun powder and spaghetti, the Chinese also showed their genius when it came to protecting themselves against risk. Although Chinese merchants were adventurous and their seafaring technology was quite solid, that did not preclude them from having the occasional shipwreck. A disaster on the water could be as ruinous then as it is now. To reduce the risks associated with shipping their wares, merchants distributed their goods to several ships in the fleet. If one happened to sink, only part of someone’s livelihood went to the bottom with it.

Pioneers in any number of areas such as inventing both gun powder and spaghetti, the Chinese also showed their genius when it came to protecting themselves against risk. Although Chinese merchants were adventurous and their seafaring technology was quite solid, that did not preclude them from having the occasional shipwreck. A disaster on the water could be as ruinous then as it is now. To reduce the risks associated with shipping their wares, merchants distributed their goods to several ships in the fleet. If one happened to sink, only part of someone’s livelihood went to the bottom with it.

1790 B.C. BABYLON

Brewing beer and writing in cuneiform were not the only accomplishments of this famous civilization. The Babylonians were consummate traders, distributing their goods from the Persian Gulf to the Mediterranean Sea. Transportation was slow and painstaking then, but that wasn’t the only difficulty. Everything from storms to pirates on the seas and bandits on the roads conspired to thwart their progress. To minimize the risks, Hammurabi, the first Babylonian king, carved the first insurance policy on a tablet. It stipulated the following: Before leaving on his voyage, a merchant took out a loan that he would pay, with interest, when the goods arrived safely at their destination. If something happened along the way, the loan was forgiven. Known as bottomry, this first-ever insurance policy gave merchants peace of mind and often yielded lenders a handsome profit, since most shipments were not lost along the way.

Brewing beer and writing in cuneiform were not the only accomplishments of this famous civilization. The Babylonians were consummate traders, distributing their goods from the Persian Gulf to the Mediterranean Sea. Transportation was slow and painstaking then, but that wasn’t the only difficulty. Everything from storms to pirates on the seas and bandits on the roads conspired to thwart their progress. To minimize the risks, Hammurabi, the first Babylonian king, carved the first insurance policy on a tablet. It stipulated the following: Before leaving on his voyage, a merchant took out a loan that he would pay, with interest, when the goods arrived safely at their destination. If something happened along the way, the loan was forgiven. Known as bottomry, this first-ever insurance policy gave merchants peace of mind and often yielded lenders a handsome profit, since most shipments were not lost along the way.

THE MIDDLE AGES

In the Dark and Middle Ages, the guild system held sway. It provided a way for budding craftsmen to get their training, working for a master for little or no pay. Eventually, they would themselves become dues-paying masters in the guild and take on their own students. In the event of catastrophe, the wealthier guilds began to keep a reserve of funds that could support a master in need. This safety net was very attractive in those dangerous times, ultimately encouraging more and more people to forsake farming for the trades. This is the forebearer of today’s group insurance coverage.

In the Dark and Middle Ages, the guild system held sway. It provided a way for budding craftsmen to get their training, working for a master for little or no pay. Eventually, they would themselves become dues-paying masters in the guild and take on their own students. In the event of catastrophe, the wealthier guilds began to keep a reserve of funds that could support a master in need. This safety net was very attractive in those dangerous times, ultimately encouraging more and more people to forsake farming for the trades. This is the forebearer of today’s group insurance coverage.

1688 LONDON

In the late 1600s, any British merchant worth his salt met with his fellows in Edward Lloyd’s coffee house. While there, they discussed and purchased insurance on the precious goods that were increasingly being shipped to the colonies in the New World. The process worked like this: Investors would find individuals, usually among the poor and desperate of London, to agree to become colonists. The investors would buy provisions for the voyage in exchange for some of the goods or profits the colonists obtained in America, including tobacco. Then, the list of cargo was brought to Lloyd’s coffee house, where, for a set premium, people would take on a part of the risk by indicating what share of the cargo they were underwriting. In this way, the risk was spread among many investors. Not long after, the first actuarial tables were invented by Frenchmen Pierre de Fermat and Blaise Pascal.

1752 AMERICA

Among many other accomplishments, Benjamin Franklin was one of Philadelphia’s finest, working to protect the citizenry against the fires that frequently destroyed property throughout the city. This happened in spite of Philadelphia’s wider streets and buildings made of brick and stone that were intended to lessen the incidence of fires. In 1752, Franklin and some of his colleagues founded the Philadelphia Contributionship, a mutual insurance company styled after its counterparts in London that was, in effect, the first property insurance. To set the rate that subscribers would pay, company officials went out and surveyed the property before setting the rates. Although the details of the policies changed over time, they initially involved a person paying a deposit that was repayable after seven years if the building did not burn down, minus fees for the initial survey, fire mark and policy.

Among many other accomplishments, Benjamin Franklin was one of Philadelphia’s finest, working to protect the citizenry against the fires that frequently destroyed property throughout the city. This happened in spite of Philadelphia’s wider streets and buildings made of brick and stone that were intended to lessen the incidence of fires. In 1752, Franklin and some of his colleagues founded the Philadelphia Contributionship, a mutual insurance company styled after its counterparts in London that was, in effect, the first property insurance. To set the rate that subscribers would pay, company officials went out and surveyed the property before setting the rates. Although the details of the policies changed over time, they initially involved a person paying a deposit that was repayable after seven years if the building did not burn down, minus fees for the initial survey, fire mark and policy.

1881 GERMANY

Believe it or not, modern workers’ compensation coverage, considered by many to be the most compassionate form of insurance, was pioneered by stern Prussian chancellor Otto von Bismarck. As a great champion of political pragmatism, Bismarck courted the loyalty of common citizens by supporting a social insurance system that covered workers in factories, railroads, quarries and mines. In 1884, he pioneered the first accident insurance, which was later followed by pension insurance for workers who were incapacitated due to non work-related events or illnesses and public aid for those who could never work due to disability. Work-related injuries always provided a person with the highest level of benefits, thus providing an incentive for people to work. The Prussian system was also first to stipulate that an injured employee could not sue his employer in the civil courts because of his injury. Even now, well over a century later, this stipulation is one of the backbones of modern workers’ compensation insurance.

Believe it or not, modern workers’ compensation coverage, considered by many to be the most compassionate form of insurance, was pioneered by stern Prussian chancellor Otto von Bismarck. As a great champion of political pragmatism, Bismarck courted the loyalty of common citizens by supporting a social insurance system that covered workers in factories, railroads, quarries and mines. In 1884, he pioneered the first accident insurance, which was later followed by pension insurance for workers who were incapacitated due to non work-related events or illnesses and public aid for those who could never work due to disability. Work-related injuries always provided a person with the highest level of benefits, thus providing an incentive for people to work. The Prussian system was also first to stipulate that an injured employee could not sue his employer in the civil courts because of his injury. Even now, well over a century later, this stipulation is one of the backbones of modern workers’ compensation insurance.